Whether you are a trader, an investor, or a fintech start-up company seeking to create your own trading platform, it’s important to bear in mind that we are living in the age of continuous innovations. Technological development has become a rat race in conquering the cutthroat market. Thus, it could be quite a challenging task to develop a perfect platform that meets market demanding expectations. But hard doesn’t mean impossible.

Overview of Mainstream Trends in Trading Platform Development

The powerful online trading platform is an essential ingredient for successful operations for the marketplace players. To go with the technological flow, consider these 5 trading platform development trends that can be used advantageously toward financial software designing:

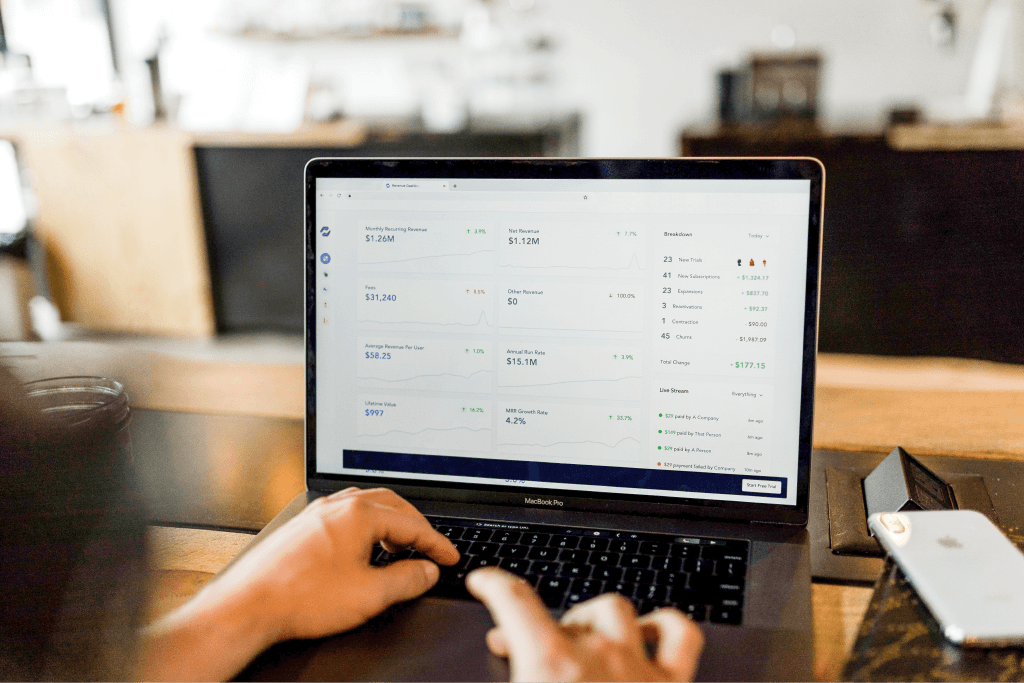

1. Progressive Charting Tools

While raw market data in digits and numbers are good for a trader to see, the more efficient way for a modern market player to view and interpret data is in the form of charts and graphs. These tools enable traders to analyze the real-time market and to keep track of current and future trades. Hence, it’s essential that charting tools are customizable and equipped with advanced and interactive features that are clear for interpreting and fast decision making.

These may include, for example:

- customizable alerts

- customizable indicators

- automated trades

- tick-chart options

- user’s account quick screenshots

- ability to add charts & graphs to other devices

- ability to submit order right from charts

Depending on traders and investors desired goals charting engines must be combined with the full range of widespread charting styles, like Line Charts, Bar Charts, Pie Charts, Candlestick Charts, Point and Figure Charts, Mosaic or Mekko Charts, 3d Graphs and others.

Taking into account our on-the-go lifestyle, charts should work flawlessly both on desktop and mobile and other portable devices.

What is most important: to make charting tools really progressive they must be compatible with a ready-to-use platform or serve as independent integrative components.

Customizability & Flexibility

To make your platform a truly effective solution provide users with the ability to set up workspace by their preferences. The main goal of customizations is to make the user experience easy, enjoyable and convenient. Nobody likes monotonously clicking around to finally reach their target.

So, you should follow a customer-centric approach while developing a trading platform and make it user-friendly. Such customizable functionalities may include:

- layout templates with the ability to save them

- data visualization customizations

- multiple-monitor support

- multiple charts view support

- browser neutrality

- easy selection of data vendors

- workspace zoom in & out

Well-designed flexible platforms will be a great fit both for newbies and pros in the trading industry. But for higher platform performance it’s better not overcomplicate customization options.

High-Speed Operations

Speed routing remains to be one of the most important features for trading software. It’s essential for platforms to have an optimized code that is ensuring clear & fast performance. Low-latency platforms help traders and investors to save money and time, and time in the trader’s world is actually money.

In fact, every second in a trading operation can cost lots of money. All feeds, presentation and order execution can be affected by high-latency. Among the well-known latency, sources are market, brokerage servers, internet connection, client hardware & software.

To ensure delay-free transaction flow, many software developers and companies today work their fingers to the bone to boost the speed of order routing and execution.

It’s crucial for developers to make sure that the platform is not the cause of unnecessary delay.

Cloud-based Technology & Mobility

Long gone the days when traders just sit in front of the desktop screen all day to place an order or analyze charts. A modern trader is a trader “on-the-go” which means that most feel themselves at ease with a smartphone or a laptop in their hands when making trades online at home or in the office, on vacation with friends or on the road.

Not only trading platforms must be fast, but it must also be mobile responsive. Advanced platforms are not just adaptable for portable devices, but optimized for them. That means all user’s preferences and customization settings are reflected on the mobile device.

Obviously, the best fit for mobile functionality is cloud-based technology. You’ll be able to work right from a mobile phone and all info will be stored and uploaded on a cloud with the access anytime & anywhere.

Same thing with trading: you can create a particular set of rules or choose indicators, design strategy from the mobile or other portable devices – all setups and customizations are saved on a cloud and then transferred on a platform.

When it comes to mobile technology it’s important to be one step ahead when adopting trading platform development trends.

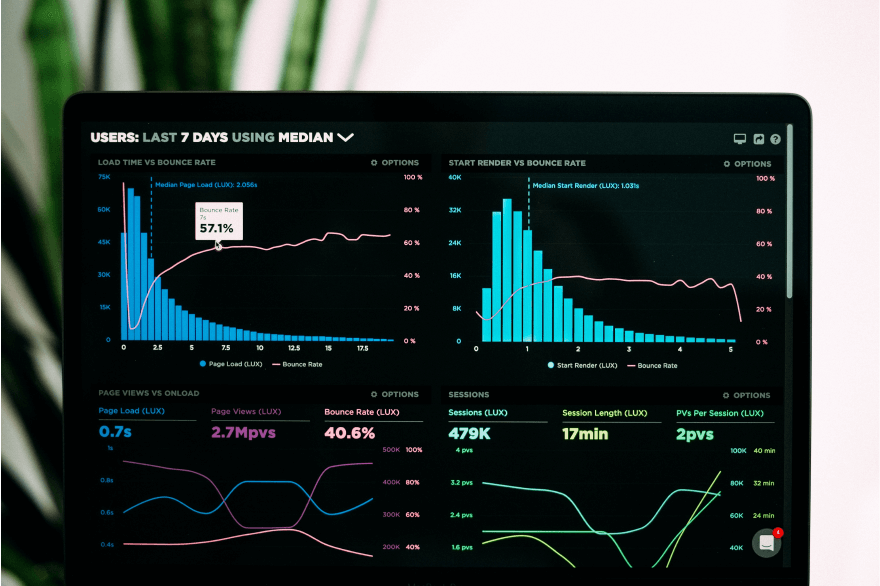

Big Data Research Tools

Effective research tools are the ones that help traders to determine trends and easily spot opportunities that fit their investment goals. What is more, good market research tools obviate the need to pay broker commissions enabling traders to make money on their own?

But what makes research tools powerful?

The emerging of the Big data technology is extremely significant for processing of huge amount of information. And fintech companies that incorporate this technology into trading platforms are able to make more insightful and precise market trends predictions with Big Data ability to access and analyze news episodes, social media feeds, and even weather conditions.

Big data technology can be a winning ticket for those who dare to compete with the giants in the stock or forex trading.